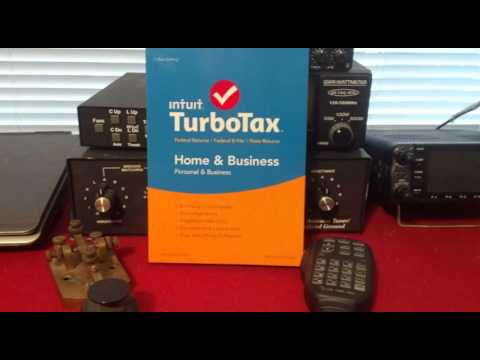

Good morning, everybody. This is North Korea prepper. It's early, and I haven't had my coffee. This video is unrehearsed, okay? So here's the deal: death and taxes are both gonna happen, and we gotta pay them all, right? Until about the 30th of this month, Turbo Tax is on sale. This one here cost me $69.39 out the door, and I went to Best Buy to buy it. Now, if you use my link below, you can just download it now from there. That's up to you. It'd be nice if you used it or bought it for me and had it shipped. That's fine. But if you don't want to do that, what you can do is go to that page. This is bought and sold by Rob Slden or made by Blend. You can go to Best Buy or any other place that does price matching. Go ahead and get it that way, and that's what I did because I wanted it. You know, I want to start doing my taxes now, and I'm still waiting on some 1099s. But if you do YouTube and you get a 1099, I believe it's a 1099 miscellaneous or maybe 1099 G. I'm not sure, but this will do it. This is the one you need. Now, I've had my tax man before do it. Generally, I filed just a 1040, and I do deductions. I do a lot of deductions, but if you've used stuff in your videos and they made you money, you can sometimes deduct it. But this goes through everything I used last year and the year before. I'm really a big fan, but you know, you do what you want. But like I said, if YouTube will send you a 1099 miscellaneous or maybe 1099...

Award-winning PDF software

1099 misc turbotax Form: What You Should Know

Apr 23, 2025 — If you're planning to rent or lease real estate, then the rent amount and any additional or “capital gains” amounts over your lease's due date should be reported on Form 1099-MISC. If you are planning on selling or leasing real estate, this IRS form is used to report the payment required to be received in cash from a sale or lease. This payment should also be reported on line 20 of Schedule D if required. Video: When to Report and When to Ignore a Form 1099-MISC — Turbo Tax — Intuit Sep 27, 2025 — This video will show you how to correctly fill out a Form 1099-MISC tax form for tax month 2019. If you received your Form 1099-MISC for 2025 and paid income or property taxes in the United Stated in the year, then you can use this video to Mar 26, 2025 — This video will show you how to correctly fill out a Form 1099-MISC tax form for tax 2025 and any tax years prior that you may be aware of. Tax-related videos from TurboT ax: • How to Complete the IRS Form 10962 for Tax Year 2025 • Why is Tax-Related Video Important? • TurboT ax's Form 1090-C: How to fill out the 1090-C • TurboT ax's 1099-MISC Form: How to report payments to others in the course of Your Trade Or Business In this post, TurboT ax shows you how to prepare your 1099-MISC form to report business payments to employees. You'll be able to use this video to answer any questions you may have about the 1099-MISC form. This video will teach you all the important information about the 1099-MISC form, such as how to properly answer a question about your business expenses. This video will also give you an example on how to print the 1099-MISC form and the information that you'll need to send to the IRS. This video answers the questions that may come up when your employer makes a payment to you as an employee. If your employer made an incorrect payment to you, this video will also teach you how to get the correct information on the 1099-MISC form to report this payment.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do SF-1190, steer clear of blunders along with furnish it in a timely manner:

How to complete any SF-1190 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your SF-1190 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your SF-1190 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 misc turbotax