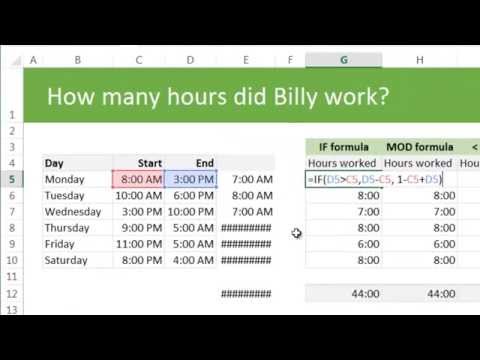

Hi and welcome to Shendu talk today. Let us understand a very interesting problem and see how to work the solution for it using various Excel formula techniques. This problem is called Billy's working-hours problem. The problem is very simple. Imagine you are looking at a time sheet or hours worker kind of sheet or an invoice from a contractor or something like that where each line item indicates the starting and ending time of a particular task. So, for example, imagine you are running a company where Billy is one of the employees and Billy sends you every week an Excel file that says on each day of the week how many hours he worked. So, it would have something like "9 a.m. Billy started working and at 6 p.m. he left the office." So, the total hours in that case would be 10 because he arrived in the morning at 8 a.m. and he left in the evening at 6 o'clock, so there are 10 hours in that time span, right? So, if you are looking at something like that and you wanted to find out the total number of hours within a range, what kind of formula techniques would you use? Now, the real twist here is, as long as you are looking at hours that are ending within one day, you are fine. But what if you are looking at something like Billy started working at 9 p.m. and ended the work at 3 a.m. in the morning? In that case, it turns out you can't really do a direct subtraction because you would end up with what is called a negative time in most cases. So, I am going to show you an example file and walk you through the process of coming up with...

Award-winning PDF software

Post hardship differential calculator Form: What You Should Know

B) Revises the function of the program to include information about the effect of the rate of pay of an individual upon his/her monthly expenditure needs. Sec. 3. (a) The Office of Personnel Management is the executive agency with primary responsibility for establishing standards for the processing of requests for, and payment of, pay, allowances, and remunerations for which a rate determination based on salary or wages is required. All requests for, and payments of, pay, allowances, and remunerations for which a rate determination based on salary or wages is required must be issued or processed under a regulation that is consistent with the following: For the purposes of this paragraph, the term “rate of pay” shall mean the percentage rate which is determined by the head or official responsible for the pay or allowance. Where a provision in statute directs that the “rate of pay” used in this definition be specified, the statutory authority shall be deemed congruent with the following: US Department of State Standardized Regulations (USSR), section 11.2.5-3, “Rates of Pay,” Pay and Allowances, March 28, 2022, in a general employment context, a rate of pay is equivalent to the salary level. For a position where a separate rate is generally charged, the rate of pay shall include the total amount of all bonuses, incentive pay, and special pay; in the absence of a specific provision for the issue or receipt of specific amounts of bonus, incentive pay, or special pay, the salary level shall be used for the purposes of these provisions. The compensation to be awarded to an employee shall be commensurate with the performance of the duties and responsibilities of the office and with the ability and resources of the employee. The salary level which shall be used shall reflect the overall level of economic well-being achieved by the office of the employee. US Department of State Standardized Regulations (USSR), section 11.2.5-3, “Rates of Pay,” Pay, Allowances, March 28, 2022, in other cases the salary level shall be determined by the Head or person responsible for the pay or allowance.(B) In cases of emergency, the highest of all rates to which the office is eligible and with the highest financial stability may be used. The rate of pay shall be in direct proportion to the financial stability of the office and the ability of the office to manage its expenditures.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do SF-1190, steer clear of blunders along with furnish it in a timely manner:

How to complete any SF-1190 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your SF-1190 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your SF-1190 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Post hardship differential calculator